- Categories:

- Direct Mail Automation,

- Direct Mail Guides,

- Mortgage Direct Mail,

Boosting your mortgage business through targeted direct mail marketing can significantly enhance your outreach and lead generation. In today’s competitive landscape, personalized and targeted messages are essential for connecting with potential customers.

This guide is all about direct mail marketing in the mortgage industry. We’re excited to share some insights and creative approaches that can help you connect with borrowers!

Understanding Mortgage Direct Mail Marketing

Mortgage direct mail marketing involves sending customized promotional materials directly to potential clients’ mailboxes. This strategy allows lenders to reach specific audiences with targeted messages tailored to their needs. Mortgage professionals can create campaigns that resonate with prospects by utilizing customer data and advanced printing techniques.

Unique Advantages of Direct Mail

Direct mail offers several benefits for mortgage lenders, including:

- Higher Engagement Rates: Compared to digital channels, direct mail often results in better engagement.

- Complex Information Delivery: It allows for the presentation of detailed information in a tangible format.

- Standout Presence: In a crowded marketing space, direct mail can capture attention more effectively.

- Creative Design Opportunities: Eye-catching designs can enhance the appeal of the message.

At Splash, we specialize in direct mail marketing for the mortgage industry and provide actionable insights to help you maximize its potential.

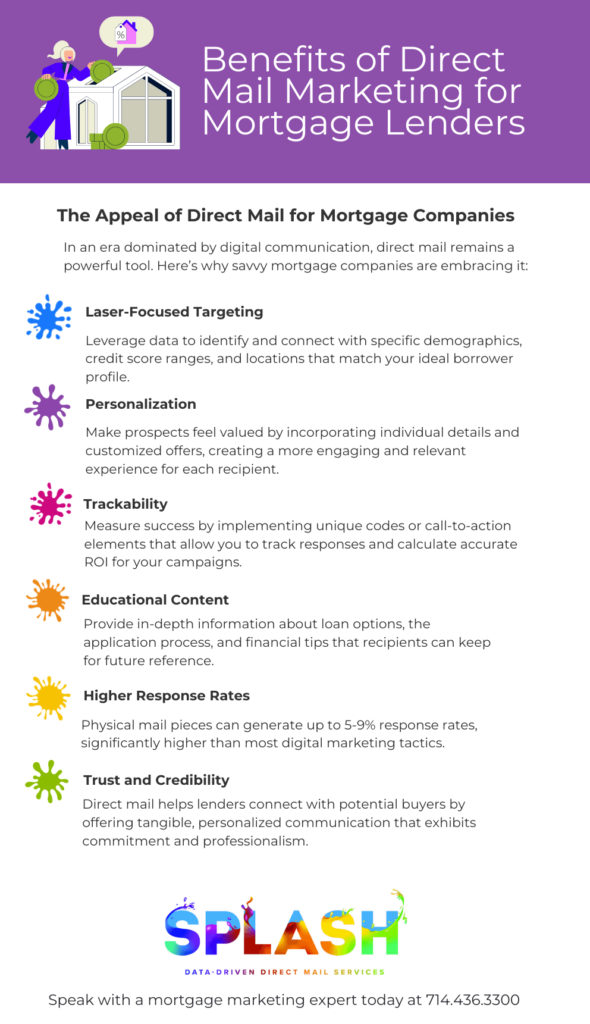

The Appeal of Direct Mail for Mortgage Companies

In an era dominated by digital communication, direct mail remains a powerful tool. Here’s why savvy mortgage companies are embracing it:

- Laser-Focused Targeting: Reach your ideal customers with precision by leveraging data to identify and connect with specific demographics, credit score ranges, and locations that match your ideal borrower profile.

- Personalization: Tailor messages to make prospects feel valued by incorporating individual details and customized offers, creating a more engaging and relevant experience for each recipient.

- Trackability: Use data-driven insights to measure success by implementing unique codes or call-to-action elements that allow you to track responses and calculate accurate ROI for your campaigns.

- Educational Content: Deliver mortgage expertise in a physical format, providing in-depth information about loan options, the application process, and financial tips that recipients can review at their leisure and keep for future reference.

- Higher Response Rates: Direct mail consistently outperforms digital channels in terms of response rates, with studies showing that physical mail pieces can generate up to 5-9% response rates, significantly higher than most digital marketing tactics.

- Trust and Credibility: Direct mail helps build credibility and trust for mortgage lenders by providing a tangible, personalized communication that demonstrates commitment and professionalism, making it easier for potential borrowers to connect with them.

Choosing the Best Direct Mail Formats for Your Campaigns

Choosing the right format is crucial for maximizing impact. Here are some effective options:

- Postcards

- Compact and impactful; engages quickly.

- Cost-effective and high visibility—no opening required.

- Great for promotions and driving traffic to landing pages.

- Letters and Envelopes

- Ideal for professional, private communications.

- Allows for detailed, personalized content.

- Can include inserts like brochures or application forms.

- Snap Packs

- Resemble important documents, increasing open rates.

- Secure format for sensitive information.

- Cost-effective with multiple components like reply cards.

- Self-Mailers

- No envelope needed, reducing costs while providing more content space.

- Ideal for showcasing mortgage products with visuals.

- Can include tear-off response cards or coupons.

- Oversized Mailers

- Stand out in the mailbox due to size.

- Ample space for detailed information and graphics.

- Memorable format that recipients are likely to keep.

Crafting a Winning Direct Mail Campaign

A well-executed direct mail campaign can be a powerful tool for reaching potential clients and driving conversions. Unlike digital marketing, which often gets lost in crowded inboxes, direct mail offers a tangible connection for borrowers that can cut through the digital noise that many borrowers see every day.

Crafting a successful direct mail campaign requires more than just sending out flyers; it demands careful strategic planning and execution. By following these essential steps, you can create a compelling campaign that captures attention, drives results, and fosters lasting relationships with your audience.

Here are essential steps to ensure the effectiveness of your campaign:

1. Building a Targeted Mailing List

A well-curated mailing list is fundamental. Focus on specific demographics such as:

- Loan type (VA, FHA, Conventional)

- Credit score range

- Geographic location

- Household income brackets

This targeted approach enhances the relevance of your communications and boosts conversion rates.

2. Crafting Irresistible Offers

To capture attention, develop compelling offers that resonate with your audience. Consider promoting:

- FHA and VA loan options

- Cash-out refinancing opportunities

- First-time homebuyer programs

- Reverse mortgages

3. Designing Eye-Catching Mailers

Innovative designs can make your mailers stand out. Options include:

- Google Street View imagery

- Hand-addressed envelopes

- Engaging brochures

Strategies for Direct Mail Campaign Success

To ensure your mortgage company’s direct mail campaigns are effective, consider these strategies:

- Personalization: Use variable data printing to customize messages.

- Integration with Digital Marketing: Combine direct mail with digital efforts for enhanced effectiveness.

- A/B Testing: Experiment with different approaches to optimize results.

Mortgage Direct Mail Marketing FAQ

How often should mortgage direct mailers be sent?

Aim for weekly or bi-weekly mailings to maintain visibility without overwhelming recipients. The optimal frequency depends on your target audience and campaign goals. For purchase mortgages, a more frequent cadence (weekly) may be appropriate during peak homebuying seasons. For refinance campaigns, bi-weekly mailings are often sufficient. It’s crucial to test different frequencies and monitor response rates to find the sweet spot for your specific audience.

What response rates can be expected for mortgage mailings?

Targeted campaigns typically see response rates between 2.7%-4.4%.1 These rates can vary based on offer relevance, list quality, and market conditions. Mortgage refinance campaigns tend to see higher response rates during periods of falling interest rates. Purchase mortgage campaigns may perform better in the spring and summer months when home-buying activity increases.

Can direct mail be integrated with digital marketing?

Yes! Combining both methods can increase response rates significantly. An integrated approach might include:

- Coordinating social media campaigns with direct mail drops

- Sending a direct mail piece followed by an email reminder

- Using QR codes on mailers that link to online mortgage calculators or application forms

- Retargeting direct mail recipients with digital ads

How long until the results are seen?

Responses usually begin within 2-3 weeks post-mailing. However, the full impact of a campaign may not be evident for 6-8 weeks, especially for mortgage products that involve longer decision-making processes. It’s important to track responses over time and consider the entire sales cycle when evaluating campaign effectiveness.

How can I track the success of my mortgage direct mail campaign?

Use unique phone numbers or QR codes to monitor campaign performance accurately. Other effective tracking methods include:

- Personalized URLs (PURLs) for each recipient

- Unique offer codes

- Call tracking software to attribute phone inquiries to specific campaigns

- Integration with CRM systems to track leads through the sales funnel

How does direct mail compare to other channels?

Direct mail often outperforms digital channels in terms of response rates in the financial services sector. According to the Data & Marketing Association, direct mail achieves a 4.4% response rate, compared to 0.12% for email. However, digital channels often have lower costs and faster deployment times. A balanced marketing strategy typically incorporates both direct mail and digital channels.2

What is the average ROI for direct mail campaigns?

According to a report from SeQuel Response, the ROI for direct mail sent to house lists is reported to be as high as 161%. This indicates that direct mail can significantly outperform many digital marketing channels, which typically have lower ROIs3.

Average ROI: United GMG states that the average ROI for direct mail is around 30%, meaning companies earn an average of 30 cents in profit for every dollar spent on direct mail campaigns4.

What budget should be allocated?

Companies typically spend between $0.30 and $1.00 per piece for targeted campaigns.5 This cost can vary based on factors such as:

- Mailing list quality and segmentation

- Design complexity

- Print quality and paper stock

- Postage rates

- Volume discounts

Which direct mail formats work best?

Postcard mailers generally perform well, but letter packages can also be effective for complex offers. The best format depends on your message’s complexity and target audience. Consider:

- Postcards for simple offers or reminders

- Letter packages for detailed explanations of mortgage products

- Oversized mailers for high-impact campaigns

- Self-mailers for cost-effective, multi-page content delivery

How can personalization benefit mortgage direct mail marketing campaigns

Personalized pieces can boost response rates by up to 50%. Effective personalization goes beyond just using the recipient’s name. Consider:

- Tailoring offers based on credit profiles or home values

- Referencing past interactions or products

- Using location-specific imagery or language

- Customizing content based on life events (e.g., new homeowners, growing families)

Speak with a Mortage Direct Mail Marketing Expert Today

Direct mail marketing serves as a powerful tool for mortgage lenders looking to connect with potential borrowers effectively. By leveraging targeted lists, personalized offers, and striking designs, you can reach customers precisely when they need your services—whether purchasing a new home or refinancing an existing loan.

Ready to elevate your mortgage business? Partner with Splash to craft impactful campaigns that resonate and drive action! Call 714.436.3300 to speak to a mortgage direct mail specialist today.

Sources:

1https://selzy.com/en/blog/comprehensive-guide-on-mortgage-direct-mail-marketing/

2https://dma.org.uk/article/why-direct-mail-is-delivering

3How Much Does Direct Mail Cost in 2024? | Taradel

4Personalization and Measuring the Effectiveness of Direct Mail

5Measuring Direct Mail ROI: Average ROI & ROI Statistics

6Personalization and Measuring the Effectiveness of Direct Mail